Driving UK Automotive Competitiveness

Executive summary

- The Government has set ambitious goals to achieve Net Zero, while simultaneously levelling up the country through spreading skills, wealth and opportunity. The automotive industry is at the centre of both goals. Moving away from the Internal Combustion Engine (ICE) is an important next step in the UK’s path to Net Zero, and the UK has set one of the most ambitious targets for the phasing out of ICE vehicles, with an end of sale date for passenger cars from 2030. Within the automotive industry, firms employ skilled workers of all kinds - from PhDs in design to apprenticeships and BTECs in engineering - in places where genuinely skilled jobs are few and far between.

- While the costs for building zero emission vehicles are falling, this is not happening quickly enough for the industry to hit the 2030 target whilst retaining its global share and volume of production. Unlike other major governments, the UK has yet to back its ambition with a matching level of investment in battery production incentives, charging networks and affordable clean energy. Independent analysts predict that by 2025, the UK will have just 12 GWh of lithium-ion battery capacity, compared to 164 GWh in Germany, 91 GWh in the US or 32 GWh in France.

- The next ten years will be crucial to the long-term future of the industry. With the right support, the industry could continue to provide good jobs and boost growth for decades to come. Without that support however, there is a real risk that the industry’s economic footprint could substantially decline. Given the long leads for investment, many key policy decisions will need to be made in the next 24 months.

The automotive industry provides good jobs, levels up the UK and is our largest exporter of goods

- For most families, the car is one of the most important technologies in their lives. 95% of car owners agree that their car gives them significantly greater freedom and mobility. Whether it is the car that drives them to work, the light van that delivers a new parcel, or the bus that takes you to the nearest shops, the automotive industry plays a crucial role in keeping the economy going.

- From MINI to Aston Martin, Jaguar Land Rover to Bentley, British brands are famous worldwide. Besides passenger cars, the UK automotive sector is also a significant producer of buses, vans and a wide range of commercial vehicles to Formula 1 cars, ambulances to taxis, as well as remanufactured products and a vast supply chain. The UK automotive industry has many important advantages: enough scale and affluence to serve across the full range of the market and support a diverse supply-chain; strong global connections; world-leading engineering; a highly skilled workforce; and healthy consumer demand.

- The industry creates many significant spillover benefits:

- Levelling up the UK. In total, the automotive industry directly contributes £15 bn in GVA for the UK economy, with the majority of the value created by the automotive industry located outside the South East of England. If the automotive industry didn't exist, we estimate that this would be enough to increase the economic gap between London and the North East by a further 9% and in the West Midlands by 3%.

- Providing good jobs. Across the UK, over 180,000 employees are directly employed in automotive manufacturing, and a total of 860,000 in the wider automotive industry, including retail, leasing and fuel supply. The automotive sector is also a significant keystone for creating and sustaining jobs in other sectors, such as chemicals, steel, aftermarket, logistics, finance and advertising. Every job in the sector creates another 1.7 jobs in the wider economy. The average wage in the automotive manufacturing industry is around 35% higher than the UK average, and in a region like the North East over 60% higher than the local wage.

- A globally competitive industry. Over 80% of cars and some 60% of commercial vehicles produced in the UK are built for export, with the UK selling into 150 markets worldwide. The automotive industry is the UK's largest source of exports for goods.

Over the next decade, the automotive industry will go through the most fundamental transformation since its creation – and the UK risks falling behind

- The industry is currently facing significant short-term pressures and costly challenges, including adapting to Brexit, a significant fall in demand from Covid-19, and a pressing bottleneck from the global semiconductor shortage. Even as these pressures may ease, the industry is likely to see significant disruption.

- The transition from fossil fuels to Zero Emission Vehicles (ZEV). This change will have significant spillover effects, from the pattern of energy demand to how we structure motoring taxation. For the industry, it will mean some of the UK's strengths in traditional powertrain design become less important.

- The rise of increasingly connected and automated vehicles. While it is difficult to predict the timeline for full self-driving vehicles, there is much less doubt that the industry will continue to become increasingly digitalised. By 2030, embedded software could make up to 30% of total vehicle value.

- Changing trade patterns, along with the wider rise of Asian markets. Measured on a volume basis, the majority of vehicles exported from the UK are headed to the EU. The evolving UK-EU relationship, geographic proximity, market strength and regulatory influence, and integrated pan-European supply chain remain critical to UK Automotive success. However, even before Brexit, exports to non-EU markets were already growing significantly faster than to the EU itself - and future trade deals offer the potential to further catalyse UK exports, particularly among premium and small volume manufacturers and open new opportunities.

The UK industry retains strong fundamentals in engineering, but is falling behind in incentives for international investment

- In order to assess how well placed the UK was to adapt and prosper on the back of these changes, we constructed a new Automotive Competitiveness Index, centred around three pillars:

- Technology & Innovation. In principle, the UK’s engineering heritage and strengths in digital and technology position it well for a relative advantage in the future automotive industry. However, without underlying base facilities such as domestic battery production and an electrified supply chain in the UK, industry could easily underperform its potential – there is already a growing gap with less generous subsidy support in the UK compared to other destinations for investment.

- Manufacturing Competitiveness. In the 1980s, the UK’s competitive environment for foreign investment helped secure new manufacturers, securing the future of domestic car production and helping drive up standards across the industry. Today, while the UK retains a strong research and engineering base, we are increasingly falling behind in other elements of competitiveness, with some of the highest energy and tax costs.

- Consumer, Market & Trade. Having access to a healthy local market helps provide sufficient scale to support a diverse sector and resilient supply chain. The UK has a relatively large domestic market, with healthy demand across different types of market segment. Leaving the Single Market has inherently increased friction and risk among the pan-European supply chain, and ensuring a strong and responsive working relationship with the European Union is essential to maintain smooth trade flows, continued market access and the ongoing running of the industry.

- Overall, we found in our index that the UK retains many of its traditional strengths: a strong science, engineering and innovation base; a flexible and highly productive workforce; a strong domestic market. With the right investment, we have the potential to secure and grow the industry for decades to come. However, we are increasingly falling behind in other indicators of international competitiveness: we have the highest business electricity costs in the EU, one of the highest levels of business rates in the OECD, relatively few tax incentives for investment and unlike many of our competitors, no longer have frictionless, zero cost access to a large regional trading block like the EU or USMCA. If these fundamentals don’t change, UK competitiveness could rapidly decrease in future years.

UK Competitiveness Index (1= best, 0 = worst)

If the industry fails to make the transition, over 90,000 jobs could be lost by 2030

- In order to assess the potential impact of these changes on the economic future of the industry, we next compiled four scenarios for the future of the industry, and looked at the resulting implications for growth and jobs:

- Central. The UK builds 60 GWh of gigafactory supply by 2030, ensuring that we have ample battery supply to maintain our current production volume, and offers significantly more generous incentives for business investment. Under this scenario, GVA and jobs return to a trajectory of steady growth.

- Optimistic. The UK builds 80 GWh, undertakes an ambitious programme of trade deals and significantly improves its attractiveness for business investment. This sees GVA grow by around a third faster than in the central scenario, and sees the sector as a whole gain around 40,000 jobs.

- Pessimistic. The UK only builds out 30 GWh of gigafactory supply, while non-tariff barriers with the EU moderately increase from the middle of the decade. Under this scenario, GVA recovers from Covid-19 and then largely stagnates, with substantial jobs lost over time.

- Stranded. The UK only builds one additional gigafactory, leaving total supply under 15 GWh and so fails to make the transition away from ICEs. As a result, around 90,000 jobs are lost, with the majority of these concentrated outside of London and the South East, further increasing regional inequality.

A roadmap to preserve and grow the automotive industry

- If we want to preserve and build on the automotive sector’s current economic contribution, significantly more government support will be needed to accelerate change. The current Automotive Transformation Fund is not large or broad enough in scope to deliver the scale of change needed. Given the long lead times of much of this investment, many crucial policy decisions will need to be taken in the next twelve months.

- In the final section of the report, we present a concrete roadmap of how the Government and the industry can work together to meet the 2030 target, and secure the investment needed to secure and grow the UK industry based on three pillars: Technology & Innovation, Manufacturing Competitiveness, and Consumer, Market & Trade. In order to ensure that we stay on track, we suggest the Government produces its own roadmap, reviewing it every two years.

Technology & Innovation

- Set an explicit Government target for the provision of 60 GWh of battery production within the UK by 2030. This would ensure that the UK has the capacity to produce up to 1 million electric vehicles domestically, and make it easier for UK produced vehicles to meet local content requirements, avoiding export controls. In order to achieve this and the required changes in the power electronics, motors and drives supply-chain, the Automotive Transformation Fund should be expedited and other broader support needed.

- Support the development of a fuel cell gigafactory with a 2 GW capacity by 2030. This would be capable of supplying the production of 17,000 cars, trucks, buses and rail units. While battery electric vehicles may make up the majority of the consumer market, hydrogen and other technologies are likely to be particularly important for heavy vehicles.

- Develop a comprehensive and long-term skills and retraining strategy that supports needs across the sector, and pilot greater Apprenticeship Levy flexibility in the sector to better support retraining The Government should work with the industry to develop retraining bootcamps, and ensure that key skills requirements are included within local skills plans, taught in the Institutes of Technology and are on the shortage occupation list for skilled worker visas.

- The UK should seek to be the best place in the world to develop, test, trial and deploy Connected and Automated Vehicle (CAV) technology. The UK's combination of leading expertise in engineering and digital technology, combined with our tradition of innovation friendly regulation, puts us in a good position to create new companies and business models here. As the Government’s recent Taskforce on Innovation, Growth and Regulatory Reform recommended, regulatory sandboxes can play a powerful role in building the evidence base on safety and new innovations.

Manufacturing Competitiveness

- Create a new Build Back Better Fund to support advanced manufacturing jobs for the future. This would help fund automotive production line transformation, skills retraining, and energy costs relief, ensuring that the UK remains competitive for investment. If this fund was of a similar order of magnitude to the funds recently proposed by the US and EU, it would be over £10 billion in size.

- Net zero critical industries, such as automotive manufacturers making low emission vehicles, batteries and fuel cells should get the same benefits and support as Energy Intensive Industries. These measures, alongside better support for trade intensive sectors in the UK Emissions Trading Scheme, and an extension of Climate Change Agreements would help reduce energy costs, and encourage investment in zero emission technologies.

- Fund trial and demonstration projects to explore the use of hydrogen during manufacturing. In the longer term, for many industrial processes such as heating and paint shop ovens, hydrogen may prove a more suitable re placement for gas than electricity.

- Ensure the UK tax system creates a globally attractive destination for investment. In order to encourage greater investment, the Government should consider removing plant and machinery from the business rates valuation, extending more generous capital allowances, and increasing R&D tax credits to a more internationally competitive level

Consumer, Market & Trade

- The Government should develop an infrastructure strategy, with a goal of ensuring that at least 2.3 million public charging points are in place by 2030. Public support is likely to be particularly important to deliver additional on-street charge points (1.95 million required), and to ensure that less prosperous areas of the country do not get left behind.

- Commission an independent review to holistically consider the long-term future of fuel, vehicle and road based taxes in a decarbonised sector. If we want individuals and families to invest in electric vehicles, we need to ensure that they have that they will not be surprised by new taxes down the line, and these new taxes in do not undermine the transition to zero emission vehicles.

- Continue Plug-in Vehicle Incentives beyond their current term and exempt Ultra Low Emission Vehicles from taxation for the next five years. A short term tax exemption, including from VAT, as well as extending consumer and fleet incentives, would help bridge the gap until ULEVs can reach total cost of ownership parity on their own and bring us in line with incentive levels in other markets.

- Work with the industry to develop an ambitious, forward looking trade strategy, which targets automotive’s most important markets. The UK should use its new trade freedoms to expand market access for the sector, particularly for high end vehicles that sell globally whilst ensuring a strong and responsive working relationship with the European Union to maintain smooth trade flows to our largest trading bloc, and protect critical supply chains.

Foreword

Time to give it full throttle

Countries around the world want a successful domestic automotive industry. It provides high value jobs, productivity and economic growth and accessible mobility. And the UK has one of the best.

The sector is built on foundations laid more than a century ago. Today it remains one of the world’s most diverse and innovative industries, a leader in manufacturing cars, commercial vehicles, engines, parts and components, a highly skilled and flexible workforce and one of the most vibrant markets that readily embraces technological change.

But the industry is a global one and the UK cannot afford to stand still. Competition is fierce. The challenges faced are myriad and seismic; electrification, digitalisation, connectivity, autonomy, mobility as a service. Yet these changes also present a once in a lifetime opportunity to transform the sector, to create new jobs, to innovate and to deliver economic growth across the country.

This new, independent report, commissioned by SMMT and written by Public First, gives a fresh perspective on how policymakers and industry can work together to realise this potential on the road to 2030.

It builds on the existing capabilities and framework and chimes with the Government’s own strategy to ‘Build Back Better’, seeking greater investment in infrastructure, in skills, innovation and, above all,

competitiveness.

Pressing full throttle on the accelerator now to create competitive conditions for battery production and electrified supply chains, helping to transition from combustion engines to zero emission transport and fostering a healthy consumer market means thousands of new, quality jobs can be created.

Hitting the brake pedal could send the sector down a dead end. Production volumes falling, trade and economic value reduced and jobs lost, many of these in automotive heartlands such as the West

Midlands and North-East. This would directly impact efforts to improve regional inequality. And any aspiration to “level up”.

So now is the time for bold decision making. With the right conditions, the right measures and the right investment, the automotive sector can remain a driver of innovation, enterprise, growth and prosperity for the next 100 years.

This ambitious report sets out exactly how we can do it.

Mike Hawes

Chief Executive

The Society of Motor

Manufacturers and

Traders (SMMT)

The Industry Today

Why mobility matters

For most families, the car is one of the most important technologies in their lives. Three-quarters of people over 17 in England hold a driving licence, and the average person spends over 200 hours a year in their car. 95% of car owners agree that their car gives them significantly greater freedom and mobility.1

Which, if any, of the following would be significantly harder for your household without access to a car?

Beyond its impact on everyday lives, the car and the wider automotive industry have been an important accelerator of growth. Whether it is the car that drives you to work, the light van that delivers a new parcel, the bus that takes you to the nearest shops or the taxi that takes you home from a night out, the automotive industry plays a crucial role in keeping the economy going. By increasing mobility, automotive vehicles save time, make it easier for workers to find new jobs, and for businesses to interact with and learn from each other. Econometric estimates suggest that every 10% improvement in accessibility leads to about a 3% local increase in the number of businesses and employment.2 In many parts of the country, motor vehicles are the only accessible ways to reach the local labour market.

New technologies such as ride-sharing have made it easier for some demographics, particularly, in urban areas to substitute car ownership for on-demand mobility.3 Overall, however, vehicle ownership is currently at near historic highs, with over 40 million vehicles registered on the road in the UK.4 While future technologies may continue to change how we access and use our vehicles, our overall dependence on mobility is unlikely to change.

In your own words, what does your car mean to you? (Base: Car Owners)

The Strengths of the UK Industry

Ever since the first invention of the automobile, the UK has been an important producer of vehicles, and today it continues to have one of the ten largest automotive industries globally. From the MINI to Rolls Royce, Jaguar Land Rover to Aston Martin, McLaren to Bentley, UK brands are famous worldwide. At the same time, international brands like Toyota, Nissan, Stellantis and Ford have made the UK a home from home.

The UK automotive industry continues to thrive because of its underlying strengths:

- Scale and scope. The UK industry does not just specialise in one type of car or market segment, but instead supports both significant volume vehicle production and more premium brands. At the same time, the UK is also a major producer of vans, buses and coaches, heavy commercial vehicles, motor caravans, wheelchair accessible vehicles and taxis, hearses, ambulances, off road vehicles and construction vehicles. This diversity creates significant economies of scale, supporting a wider supply chain that the whole industry can benefit from. There is also a sizeable aftermarket and remanufacturing industry.

- Global. The UK volume market is both well integrated into the wider European industry, and sees substantial exports globally, notably in the premium and luxury brands. The UK's traditional advantages in language, time zone, and economic openness have helped support a significant export industry.

- Engineering excellence. The UK is a world centre for advanced engineering, with a particular focus in engine design. Every year, the automotive sector invests over £3 billion in research and development, some 13% of all UK business R&D.5 Six of the ten Formula One teams are based across the country and the UK has the most specialist vehicle manufacturers of any country across the globe.

Cummins, England

Cummins is a US-headquartered global power leader with a significant presence in the Midlands and North East of England.

At its Darlington plant, over 1,100 employees are busy turning out 310 diesel engines a day. These engines are being used in a range of applications such as city buses, delivery trucks, construction and farming equipment, and boats. The design, manufacture and distribution of advanced diesel engines demand a highly diverse team, with the site employing engineers from graduate to PhD-level, manufacturing experts, marketing and sales personnel, finance, business services and regulatory affairs professionals. With similar-sized sites in Huddersfield and Daventry, Cummins provides over 4,000 jobs in the UK.

Powering this success is the company’s extensive investment in research and development in the UK – on average, around £70 million a year. With R&D sites across the UK, the company is buzzing with innovation. For example, at its Huddersfield Technical Centre, a Cummins-led consortium is working on a game-changing advance in air handling technologies for hybrid and fuel cell powertrains. Funded by a Government grant via the Advanced Propulsion Centre, the project – involving 220 engineers and technical staff – will deliver reductions in CO2 emissions, and fuel consumption for heavy-duty vehicles. Meanwhile in Milton Keynes, an 80-strong team is focused on the next generation of battery technology. At Darlington, over 100 engineering personnel are working on the clean power solutions of tomorrow, that will meet Euro VII standards and beyond.

This relentless pursuit of new technologies has enabled Cummins' success around the globe. Almost half the engines produced at Darlington are sold abroad. Not only is the company’s manufacturing expertise in high demand in Europe, the Middle East and North America, Cummins has had great success exporting to China and Turkey. By investing in cutting-edge engineering development to create cleaner, more sophisticated engines, Cummins has been able to drive sales into developed and emerging markets.

Levelling up the UK

In total, the automotive manufacturing industry directly contributes £15 bn in GVA for the UK economy, the equivalent of 0.8% of the total UK economy. While the UK manufacturing sector as a whole has largely stagnated, the UK's automotive industry has thrived in the last decade, with GDP increasing by over a third since its low point of 2011. The automotive sector is responsible for over 20% of total manufacturing investment.

Real GVA of automotive industry vs manufacturing industry from 2008-2019

Unlike other leading UK industries, the value created by the automotive industry is overwhelmingly located outside the South East of England. While around 61% of the IT or financial industries are located within London and the South East, for the automotive industry, it's just 12%. Instead, the automotive industry has concentrations across the country, with the sector generating 6.8% of the local economy in the West Midlands and 3.5% in the North East.

Percentage of total automotive GVA per region of the UK

If the automotive industry didn't exist, we estimate that this would be enough to increase the economic gap between London and the North East by 9%, or between London and West Midlands by 3%.

Allied Vehicles, Scotland

For a family with a child who uses a wheelchair, having a vehicle that’s been adapted to suit their needs is life-changing. It means being able to do more of the things that any other family can do, such as getting to the shops, spending time at the park or going on holiday together. The same is true for thousands of others in Britain who rely on wheelchair accessible vehicles. For them, it means freedom, dignity and a better quality of life. The difference this can make to a person’s wellbeing, mental health and happiness is invaluable.

Based in Glasgow, Allied Vehicles purchases newly-made cars, people carriers and minibuses from major manufacturers and sets about converting them for use by people in wheelchairs, both as passengers and drivers. Completing around 100 vehicles every week, the process involves making significant changes to what initially rolls off the production line at an automotive plant. A vast range of interlocking challenges must be overcome, from lowering the floor of the vehicle to rerouting exhaust systems, moving fuel pipes and relocating fuel tanks. To carry out the transformations whilst keeping pace with a constant flow of changing regulations, Allied’s innovative team is every bit as complex as the modern vehicles they adapt, comprising engineers, regulatory experts, auto-electricians and specialist purchasers.

Looking ahead, the transition to hybrid and electric vehicles presents a major challenge for companies like Allied, because of the need to lower the floor of the vehicle - just where traction batteries are invariably located. This is something which Allied's engineering team is starting to grapple with, in anticipation of increasing EV demand as the UK and other European countries phase out ICE vehicle sales.

Founded almost 27 years ago on the site of a former ironworks (which traces its history back to the 1860s), Allied has grown to employ over 530 people at its factory in Possilpark, one of the most deprived areas of the UK. Allied takes great pride in providing skilled and semi-skilled jobs in the form of engineers, designers, laser cutters and welders, for example. Very few people are qualified to work in modified vehicle assembly, so Allied invests heavily in on-the-job training for newly-recruited staff. So while the skills required are possessed by few, the opportunity is open to many.

Allied’s economic impact runs far beyond Glasgow. It isn’t just a Scottish and British success story but an international one too, being the biggest manufacturer of wheelchair accessible vehicles in Europe. With components sourced from trusted partners, the supply chain for things like electrical components, wheelchair struts and specialist seats stretches right across the UK and abroad. In developing into a high-volume, £150 million-turnover company, Allied has grown its buying power and in doing so played a significant role in reducing the price of wheelchair accessible vehicles, bringing them within the reach of thousands of families across Britain. This is an area which continues to grow strongly, via a network of distributors across most major European countries.

Providing Good Jobs

Across the UK, over 180,000 employees work for the automotive manufacturing industry. Over 3,000 businesses exist in the sector, with the vast majority of those being SMEs. While many people picture the automotive industry as being dominated by large manufacturers, in reality 40% of the workforce are employed by small companies.

The median wage in the automotive industry is around £35,000 a year, or 35% higher than the UK average. If you look at the regions where the industry is strongest, the disparity is even stronger. In the North East, average wages in the motor industry are 62% higher than average regional wages, and in the West Midlands 59% higher. One in six manufacturing jobs in the West Midlands is in the automotive industry.

Average Wage vs Automotive Industry Wage across the country (£)

Beyond its direct impact, automotive also serves as an anchor industry for the wider manufacturing sector. Every job in the sector creates another 1.7 jobs in the wider economy. Automotive helps support jobs in sectors from chemicals and steel to finance and advertising. Across the OECD, there is a clear correlation between the strength of the automotive industry and the wider manufacturing sector.

Manufacturing share of GVA vs Automotive share of GVA

In order to learn more about the views of those currently working in the automotive sector, as part of the research for this report, we held an online focus group with long-serving workers to discuss their careers, their experiences in the industry and their wider expectations for the future. Seven participants employed at three major manufacturers across the Midlands and North of England took part, whose roles varied from line operatives to engineers and section managers.

We found that:

- They were fiercely proud of the quality of British workmanship. They saw this as a key reason why the UK is able to compete with other potentially lower cost vehicle plants in, for example, China, Turkey and Slovakia.

- They also placed a high value on the good pay and job security offered by the industry. They took pride in being associated with prestigious companies that provided so many jobs in the local area.

- While future changes in the form of greater automation and the end of combustion engine vehicles did not worry them unduly, they were concerned about what would happen to their communities if the automotive industry declined. They see clearly in their everyday lives the positive impact of the jobs provided by vehicle manufacturing in the local economy.

Meritor, Wales

Meritor employs around 500 people at its facility in Cwmbran, Torfaen. Cwmbran is a relatively “new town” set in the Eastern Valley. Areas of the South Wales Valleys suffer some of the highest levels of deprivation in Wales. Most of its employees come from the local area, with the company supplying some of the biggest names in the global commercial vehicle industry including Volvo, Iveco and Scania.

Meritor will now play a vital role in accelerating the transition of the commercial vehicle sector to a Net Zero future. After successfully bidding for a 50% grant aid of a £31.9 million project, UK Government funding will create a new eMobility Centre of Excellence, with expanded laboratory and R&D facilities. Its role will be to run a development project – effectively creating an entirely new business – which will lead to the building of prototype vehicles that will pave the way for electrified heavy trucks in Britain, Europe and across the world.

It will demand every bit of Meritor’s extensive experience to solve the challenge of creating zero emission HGVs. The company’s American team has developed an ePowertrain for trucks in the US, where the longer chassis provide the space for two axles. Meritor’s UK experts are working on a new configuration with a single ePowertrain suitable for European HGVs, overcoming complex problems to engineer a game-changing electric powertrain for heavy-duty vehicles up to 44 tonnes – which will be capable of covering the hundreds of kilometres demanded. It is no accident that Meritor is in a position to take on this unique challenge. It follows years of investment, including spending around £36 million in the last decade to build a new facility within the footprint of its existing site, harnessing greater automation and recruiting experts in a range of disciplines. It means South Wales will not only be a hub of innovation and green technology but will also, according to Government estimates, create more than 1,000 skilled jobs across the country.

A Globally Competitive Industry

The automotive industry has long been one of the UK's most global industries, with high levels of exports, imports and inward investment. Ever since the 1980s, the UK's competitive business environment has helped secure substantial foreign direct investment. This investment, in turn, helped to support wider efficiency gains across the industry.

Today, 81% of cars and 59% of commercial vehicles produced in the UK are built for export, with the UK selling into 150 markets worldwide. The automotive industry is the UK's largest source of exports for goods, and the 6th largest source of exports overall.6 Since the depths of the financial crisis, total exports have more than doubled in real terms.

UK exports over time (billion £)

As important as exports, the UK has an open, competitive market, with imports serving the majority of domestic market demand. In 2020, 87% of new cars registered were imported. The UK's low trade barriers help ensure that consumers have a wide choice of vehicles to suit their needs, and that the domestic industry competes to add value where it can be most productive.

Toyota, East Midlands & Wales

Toyota is not just one of the world’s top two vehicle manufacturers by sales and volume, but it is a key part of the automotive industry in the United Kingdom - and has an outsized impact in both Wales, where it builds world-leading hybrid engines for vehicles including Corolla and CHR , and the East Midlands where it assembles Corolla vehicles.

Toyota’s engine plant in Deeside - on the site of the former British Steel plant at Shotton - exports hybrid engines across the world. The plant is a key anchor for manufacturing in Wales, providing 600 jobs directly and many more indirectly in the local economy.

Casting aluminium engine blocks is an energy-intensive part of an industry where utility costs need to be kept to a minimum. New furnaces will cut both CO2 emissions and bills at a time of rising costs. Both of Toyota’s UK plants operate their own solar arrays and Deeside is involved in a future project to use gas from domestic waste. Globally, Toyota is committed to being totally carbon-neutral in its manufacturing and vehicles by 2050.

Both Deeside and the vehicle assembly plant at Burnaston near Derby are regarded as two of Toyota’s environmentally-sustainable manufacturing plants globally.

As a world leader in hybrid engines, Toyota has saved 140 million tonnes in CO2 emissions from vehicles since the first Prius was sold in 1997. While battery-electric vehicles are one way of cutting carbon from mobility, technologies like hybrids and, potentially, hydrogen will also make a major contribution in the short and long term - especially for lorries and buses.

Toyota supports business across Wales and the rest of the UK. Its Lean Manufacturing Centre provides expertise to small and medium businesses who are able to tap into the expertise of one the world’s most admired manufacturers in techniques such as Continuous Improvement and learn how to be globally competitive.

Toyota's commitment to local communities is underlined by its Charitable Trust, which together with Toyota UK has contributed more than £7 million to causes local to both UK plants since 2002. Both Deeside and Burnaston played a key role in the fight against Covid this year by operating testing centres in their grounds for local people to use.

Transition

Over the last five years, the UK automotive industry has been hit by multiple major disruptions. Ongoing uncertainty throughout the Brexit negotiation process, leaving the Single Market, wider disruption from Covid-19 and the global semi-conductor shortage have all created significant short-term pressures for the industry. Between 2018 and 2020 real automotive GVA fell by a third, a fall four times larger than for the UK economy as a whole.

Many of these challenges will continue to affect the industry for some time to come. While automotive demand has started to recover, the ongoing semi-conductor production bottleneck could cost the automotive industry £110 billion in 2021,7 and together with other Covid concerns risk the production of 100,000 vehicles in the UK.8 Several competitors, such as Germany, continue to use short time working regimes to ensure manufacturing competitiveness and an agile, reactive workforce to better weather unexpected economic shocks or supply chain issues which the UK could explore following the experiences and learnings of Covid-19.

Over the next decade, the global automotive industry is likely to go through the largest changes since its creation, with at least three major concurrent structural shifts that could have a major effect on business models and value capture:

- The shift away from the internal combustion engine to electric vehicles

- The rise of increasingly connected and automated vehicles

- Changing trade patterns, along with the wider rise of Asian markets

1) The shift away from the internal combustion engine to electric and hybrid vehicles

With road traffic responsible for around 15% of global CO2 emissions,9 decarbonising transport is one of the most important steps on the path to net zero. Over the last decade, the cost of battery packs has already fallen 89% from around £715 per kWh in 2010 to around £97 per kWh in 2020.10 In the next ten years, this shift is likely to continue, with total cost of ownership of electric vehicles anticipated to reach parity with ICEs, and ultimately falling beneath them.

This change will have significant spillover effects, from the pattern of energy demand to how we structure road taxation. For the industry, it will mean some of the UK's strengths in traditional powertrain design and manufacture become less important. Given the high costs of transporting heavy batteries and the low margins on most models, having a geographically close source of battery production can make a significant difference to a production's line viability.

While there is now a consensus that battery electric cars are likely to dominate the consumer market, other power sources such as hydrogen are likely to be needed, especially for heavier commercial vehicles due to their greater power density requirement, and the higher opportunity costs of long charging times. Similarly, hydrogen is also likely to be required to replace the current use of fossil fuels, notably gas, for some elements of the vehicle production process itself.

Evolution of Li-ion battery price (automotive packs)

2) The rise of increasingly connected and automated vehicles

Like many industries, the automotive industry has become increasingly digitalised. A modern high end car already runs on 100 million lines of code - significantly more than Microsoft Office, Facebook or a F-35 fighter jet - and by 2030, McKinsey estimates that embedded software will make up to 30% of total vehicle value.11

While it is not clear when cars will safely achieve full self-driving capability across all environments (‘Level 5’), software is already increasingly acting as a driver aid. The Department for Transport has announced that by the end of the year vehicles will be allowed in the UK to operate automated lane-keeping services (ALKS) at speeds of up to 36mph (60 km/h), while in 2020 Waymo launched a fully driverless taxi service in Phoenix, Arizona. Over the next 20 years, the scope and reliability of automated systems is likely to further continue.

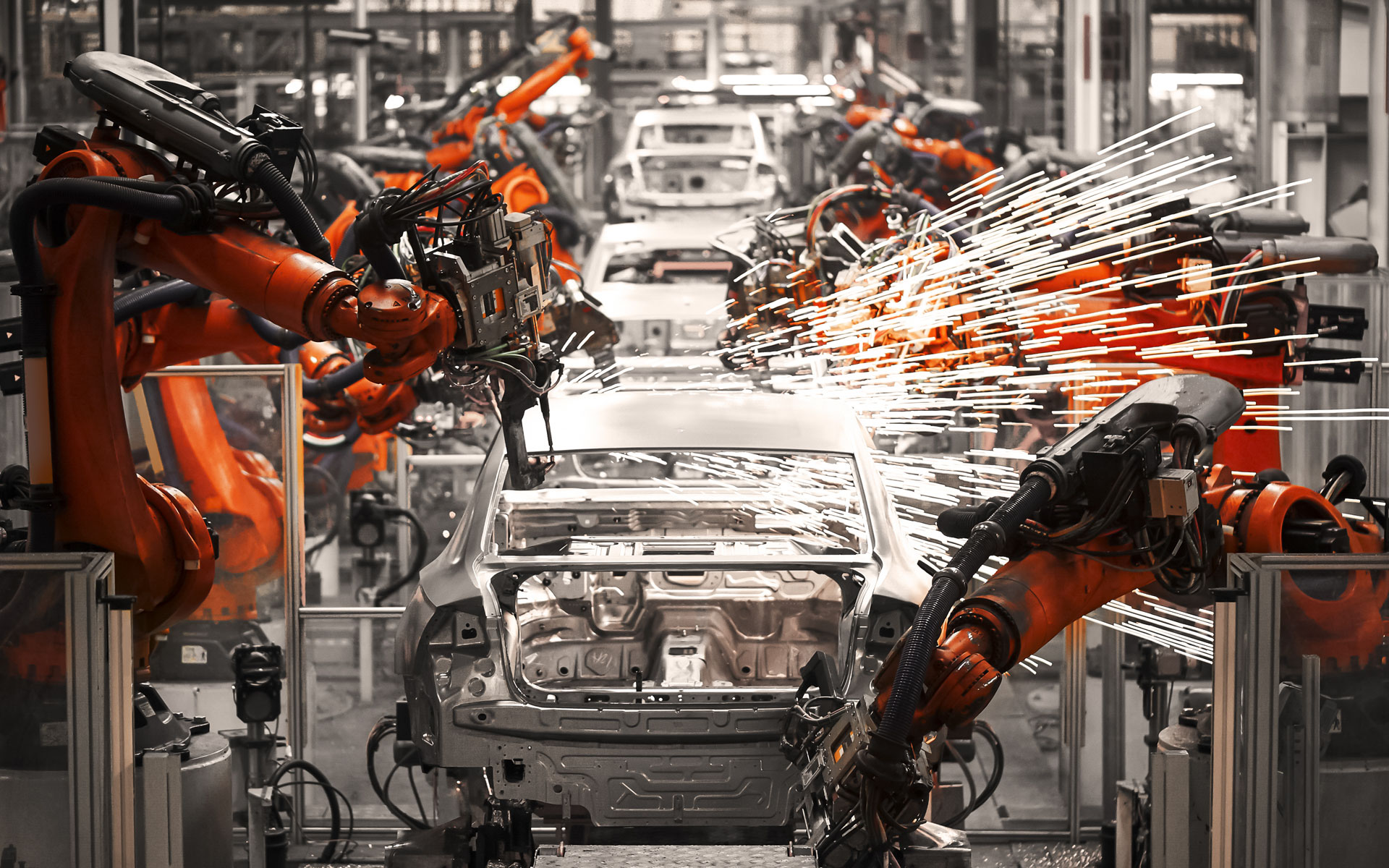

Almost as significant as AI on the roads, is the potential for AI and automated systems to increase productivity in the much more controlled environment of the production line. Automotive manufacturing is already one of the largest industrial users of digital engineering and robotics, and this is only likely to increase in future with significant spillover effects on the industry’s skills requirements.

3) Changing trade patterns, and the wider rise of Asian markets

Over the last fifty years, the centre of gravity for the industry has increasingly shifted east. At the regional level, European production has increasingly moved to countries such as Slovakia, Poland and Turkey. Globally, China, India and Thailand have seen a rapid ramp up of production, while traditional industrial centres such as the US and Japan have shrunk or stagnated.

Total Vehicle Production change since 1999

For the UK specifically, leaving the EU’s Single Market increases our vulnerability to future trade barriers within our regional market and wider supply chains. Measured on a volume basis, the majority of vehicles exported from the UK are headed to the EU.

At the same time, even before Brexit, the value of exports to non EU markets were already growing significantly faster than to the EU itself - and future trade deals offer the potential to further catalyse UK exports here, particularly among premium and small volume manufacturers if the right provisions and workable rules of origin can be secured for current and next generation vehicles.

Total value of UK automotive exports (broken down by EU vs Non EU, billion £)

How competitive is the UK?

How well is the UK prepared to take advantage of these wider changes in the automotive market and industry?

As with many disruptive changes, these trends create new opportunities for the UK to increase its market share - but also present new significant risks that the industry could further shrink.

In order to assess the UK’s potential, we compared the UK’s competitiveness across three dimensions:

- Technology & Innovation. How well positioned is the UK for the transition to an electric and automated future?

- Manufacturing competitiveness. Can the UK continue to compete with other international destinations for manufacturing investment?

- Consumer, Market & Trade. Having a strong domestic market and frictionless access to countries close by helps provide the economies of scale to support a diverse sector and resilient supply chain.

For each dimension, we collected a range of metrics and compared the UK’s performance against some of its most important rivals for industry investment: Australia, Canada, Czech Republic, France, Germany, Italy, Japan, Poland, Slovakia, South Korea, Spain, Turkey, and the US.

There are multiple different ways to assess competitiveness, and other reports have used slightly different metrics. The 2018 International Competitiveness report from the Automotive Council, for example, judged that the UK was highly competitive in academic research, labour flexibility and overall productivity, but suffered from weak skills, R&D investment and risk from Brexit.12

For the purposes of this report, we focused not just on current drivers of competitiveness - but also drivers that are likely to be more important in future years. We also focussed on what best predicted overall labour productivity and GVA, rather than just maximining exports or vehicle production. (If we had weighted the other factors more highly Slovakia, for example, would likely have done significantly better). More details on our overall approach are given in Appendix B.

Overall, we found in our index that the UK retains many of its traditional strengths: a strong science, engineering and innovation base; a flexible and highly productive workforce; a strong domestic market. With the right investment, we have the potential to secure and grow the industry for decades to come. However, we are increasingly falling behind in other indicators of international competitiveness: we have the highest business electricity costs in Europe, one of the highest levels of business rates in the OECD, relatively few tax incentives for investment and unlike many of our competitors, no longer have frictionless access to a large regional trading bloc. If these fundamentals don’t change, UK competitiveness could rapidly decrease in future years.

UK Competitiveness Index (1= best, 0 = worst)

| Technology & Innovation | Manufacturing Competitiveness | Consumer & Demand | Auto Competitiveness Index | |

| UK | 0.39 | 0.44 | 0.23 | 0.36 |

| Australia | 0.22 | 0.23 | 0.20 | 0.22 |

| Canada | 0.42 | 0.38 | 0.27 | 0.36 |

| Czech Republic | 0.10 | 0.40 | 0.35 | 0.30 |

| France | 0.34 | 0.48 | 0.44 | 0.42 |

| Germany | 0.50 | 0.61 | 0.33 | 0.49 |

| Italy | 0.24 | 0.28 | 0.34 | 0.29 |

| Japan | 0.28 | 0.57 | 0.49 | 0.46 |

| Poland | 0.21 | 0.35 | 0.39 | 0.32 |

| Slovakia | 0.09 | 0.31 | 0.25 | 0.22 |

| South Korea | 0.38 | 0.39 | 0.31 | 0.36 |

| Spain | 0.20 | 0.39 | 0.36 | 0.32 |

| Turkey | 0.14 | 0.35 | 0.35 | 0.28 |

| US | 0.76 | 0.64 | 0.77 | 0.72 |

UK Competitiveness Index (1= best, 0 = wost)

Technology & Innovation

The UK’s expertise in engineering and engine design has helped the British industry continue to thrive. In the future, however, the shift in powertrain from internal combustion engine to electric will require significant industry adaptation. In principle, the UK’s engineering heritage and strengths in digital and technology position it well for a relative advantage in the future automotive industry. However, without underlying basic facilities such as domestic battery production and an electrified supply chain in the UK, industry could easily underperform its potential - there is already a growing gap with less generous subsidy support in the UK compared to other options for investment.

- Production infrastructure for electric vehicles. While it is still early days, at present the UK’s infrastructure for producing electric vehicles lags behind market leaders such as the US and South Korea. Unlike other major governments, the UK has yet to back its ambition with a matching level of investment in production incentives, charging networks and affordable clean energy. Independent analysts predict that by 2025, the UK will have just 12 GWh of lithium-ion battery capacity, compared to 164 GWh in Germany, 91 GWh in the US or 32 GWh in France.13 Without its own domestic battery supply, UK vehicle producers are always likely to face a competitive cost disadvantage with their rivals - while UK subsidies for electric vehicle production are increasingly lagging behind those offered by other countries.

- Consumer incentives for electric vehicles. Just as with traditional ICE vehicles, having a strong consumer base is likely to create a strong halo effect for investment. Given consumers cite purchase costs as a key barrier to uptake, the UK’s consumer incentive package is looking increasingly weak against international markets. UK consumer incentives are in some instances only a third the size of those offered in other EU countries, such as Germany (See Appendix A for more details). Whilst the UK currently has the second largest charging network in the EU, it still needs considerable upscaling – at the rate of 700 chargers a day – to meet expected needs in 2030.

- Startups and Digital. By quite some margin, the UK is the leading tech and digital hub of Europe in general,14 and more specifically, one of the most important centres for research in AI and machine learning. Combined with the Government's relative agility on adapting regulation for automated vehicles, the shift towards increased digitalisation of the sector is likely to raise the UK's relative competitiveness. Investment in UK mobility tech more than tripled between 2019 and 2020, from £480 million to £1.6 billion.

Technology & Innovation (1= best, 0 = worst)

How the UK’s incentives for electric vehicles compares

| Charging network incentives | Purchase incentives | Gigafactory/investment support | Current EV stock (2019) | Committed phase out date | |

| UK | Discount of 75% (up to £350) on purchase and installation of chargers, plus a 100% first year tax allowance for EV charging equipment. | 35% (up to £2,500 maximum on vehicles priced under £35,000) on the purchase of an electric car, exemption from vehicle excise duty, and free parking in many local towns and cities | Current capacity is only 2GWh (Sunderland Envision site), although there are plans for Britishvolt to construct a gigafactory in Northumberland which will bring an extra 10GWh by 2025. | 270,150 | 2030 (end of new sales of ICEs) 2035 (100% ZEV sales) |

| US | One of the most common incentives is price reductions for charging EVs during off-peak hours. Other utilities incentivise purchasing EV charging equipment through rebates. | $7,500 federal tax credit for purchasing a new EV, in addition to other available state incentives. As of November 2020, forty-five states and the District of Columbia provided incentives for certain types of EVs. | The US is a leader in lithium-ion battery production, with a capacity of 42 GWh in 2020. Of this, 35 GWh is produced by Tesla at their gigafactory in Nevada. | 1,455,210 | 2035 (end of ICE sale for California) No set date for entire US |

| Germany | Grants provided by local governments and energy providers for up to €2,500 on the purchase and installation of chargers for private individuals. | Incentives of up to €9,000 for fully electric vehicles and €6,750 for hybrids. Also extra local grants (up to €1,500). Tax benefits include a 10 year tax exemption for full EVs and reduced tax for plug-in hybrids. Other local EV perks include free/discounted parking, bus lane usage and reserved parking spots in specific towns and cities. | €2.5bn will be spent on battery cell production and the expansion of charging infrastructure. This builds on Tesla’s 2019 announcement of the construction of its first European gigafactory near Berlin which would add an extra 100GWh of capacity to Germany in the space of 5 years. Other companies also plan on generating battery capacity in Germany, taking it from 0 GWh in 2020 to 164 GWh in 2025. | 279,890 | N/A |

| France | Up to 50% off purchase and installation of charging points. Municipalities get €2,160 for each charging point installed. | Grants for full EVs of up to €6,000 in 2021 and €1,000 for PHEVs. | Companies such as Saft and Verkor are planning on increasing France’s lithium-ion battery production capacity, providing 16 GWh each by 2025. Renault and PSA are also joining forces with French energy company Total to manufacture batteries for electric and hybrid vehicles. | 276,140 | 2040 (100% ZEV sales) |

| Spain | Possibility for grants between 30-40% (up to €100,000 ) on the purchase and installation of public or private EV chargers. | For private individuals, grants for passenger vehicles can rise to €5,500, with purchases of coaches receiving up to €15,000. | Spanish government partnering with SEAT and power company Iberdola to build the country’s first factory for EV batteries. | 46,521 | 2040 (100% ZEV sales) |

| Czech Republic | Equivalent of €5.2m of public money made available for companies installing charging points across the country. As part of the national recovery plan an additional €200 million will be spent on public charging points | Subsidies of up to 75% for companies when buying EVs. EV owners are also exempt from road tax and, in Prague, can park for free in the blue zones reserved for residents. | Current capacity (0 GWh) | 5,223 | N/A |

| Slovakia | The operation of a publicly-available charging station is exempted from the licensing duty. | Until the end of 2018 there was a grant of €5000 for a BEV and €3000 for a PHEV available (buying before June 2018). From July 2020 there have been no known purchase subsidies available, but EVs do have no tax or registration fees and are exempt from low emissions zones. | Plans for Slovakia’s lithium-ion battery capacity to increase from 0 to 10GWh by 2025 through a factory being built by battery manufacturer Inobat. | 1,422 | N/A |

| Japan | Planning on modernising EV charging infrastructure through updating old charging points with more than 250 of ABB’s new Terra 184 chargers. These are high power, compact chargers that reduce charging congestion and will upgrade/complement the current 7,000 high power chargers and 18,000 low-power chargers currently available. | Recent increase in EV purchase subsidy up to around €6,340 , with PHEV subsidies increasing to around €3,200 . | Current capacity: 17GWh (2020) | 302,720 | 2035 (100% electrified sales) |

| Korea | Soon, new and existing buildings will be required to be equipped with EV chargers, with an aim to raise the EV-charger ratio to at least 50%. At least 123 high-speed chargers will also be installed. | The South Korean government are heavily subsidising EVs, with prices dropping by the equivalent of at least €7,500 by 2025 | Major Korean battery makers - LG Energy Solution, Samsung SDI and SK Innovation - together control over 34 percent of the global EV battery market, almost double the 16 percent share they held in 2019. | 92,430 | N/A |

Manufacturing Competitiveness

In the 1980s, the UK’s competitive environment for foreign investment helped secure new manufacturers, securing the future of domestic car production and helping drive up standards across the industry. Today, while the UK retains a strong research and engineering base, we are increasingly falling behind in other elements of competitiveness, with some of the highest energy and tax costs.

- R&D. The UK remains ones of the leading global research centres in automotive. Based upon academic citation metrics, UK research in automotive engineering has among the highest impact in the world. However, private industry spends an order of magnitude less on private R&D than leaders such as Germany, Japan and the US.

- Skills. The UK’s existing workforce is highly skilled, with the third highest level of labour productivity in Europe. However, our supply of STEM graduates lags behind other OECD countries, and the industry is suffering from an increasingly pressing shortage from the wider skills pipeline.

- Labour costs. Compared to less advanced economies, the UK has relatively high labour costs. In the future, it is possible that the future automation of the industry will decrease the relevance of this factor - but for now, the UK has prospered more by focusing on middle and high end vehicles than the cheapest volume vehicles.

- Energy. Businesses in the UK currently face the highest electricity costs in the EU, and this is likely to become increasingly important as the industry transitions to electric vehicles and battery manufacturing. While some energy intensive industries such as steel or chemicals are given rebates for the costs of past renewable subsidies, this currently does not apply to the automotive industry.

- Business competitiveness. The UK has internationally competitive infrastructure, a flexible economy and relatively low taxes. However, the Government has also announced significant rises to corporation tax, the super allowance for capital investment is currently set to expire in 2023 and tax incentives for R&D lag behind global leaders.

Manufacturing Competitiveness (1= best, 0= worst)

Consumer, Market & Trade

The UK has a relatively large domestic market, with healthy demand across different types of market segment. However, leaving the Single Market has inherently increased friction and risk among the European supply chains, significantly increasing vulnerability compared to other countries that maintain frictionless access to a large trading block like the EU or USMCA. Ensuring a strong and responsive working relationship with the European Union is essential to maintain smooth trade flows, continued market access and accelerate consumer uptake of zero emission vehicles.

- Size of local market. Given the relatively high cost of transport, having a strong, diverse domestic market is an important draw for manufacturing. In 2020, the UK had the third largest domestic car market in Europe - but the majority (80%) of domestically manufactured vehicles are still produced for export.

- Trade. The recent UK-EU Trade and Cooperation Agreement preserves the UK’s tariff and quota free access to EU markets in the short term, but does not eliminate the new administrative burden or associated costs. Furthermore, in future, the UK could be vulnerable to tariffs under Rules of Origin requirements - particularly if valuable components such as batteries have had to be imported from outside the UK and/or the EU.

The UK has one of the largest domestic automotive markets, with healthy demand across different types of consumer segment. However, it scores less well on our overall index given the increased vulnerable to its regional trade links, which remain highly important, particularly to the volume market.

Consumer, Market & Trade strength (1= best, 0= worst)

Registration or Sales of New Vehicles (All Types) By Country

What potential for the future?

Given the wider changes facing the sector, what is the potential for its future economic evolution?

In order to assess the range of options, we compiled four scenarios for the future of the industry, and looked at the resulting implications for growth and jobs:

- Central. In our base scenario, total demand for vehicles continues to grow in line with the recent trend, but with electric vehicles gradually taking up increasing market share. The UK builds 60 GWh of gigafactory supply by 2030, ensuring that we have ample battery supply to maintain our current market share. The current trading arrangements with the EU are rolled over, but the UK hasn’t completed other significant trading deals. The UK’s other fundamentals become around 10% more competitive, due to a mix of higher R&D spending, lower electricity costs and the UK benefitting from the increased digitalisation of the sector.

- Pessimistic. In our pessimistic scenario, the UK only builds out 30 GWh of gigafactory supply, enough to cover only around half total vehicle production today. Non-tariff barriers with the EU moderately increase from the middle of the decade, and no substantial new trade deals are signed. The UK’s other competitive fundamentals decline by around 10%, as a result of higher business taxes, increasing energy costs and ongoing skills shortages.

- Optimistic. In our optimistic scenario, the UK builds 80 GWh of gigafactory supply by 2030, enough to serve rapidly growing supply. The current trading arrangements with the EU are rolled over, and the UK undertakes an ambitious programme of trade deals which helps significantly bring down tariffs and non-tariff barriers in non EU markets. Thanks to aggressive action to increase our attractiveness for investment, overall competitiveness increases by 15%.

- Stranded. Finally, we compiled one extremely negative scenario - of what happens if the UK only builds around one additional gigafactory (or 15 GWh in total supply). (Trade evolves in line with the pessimistic scenario, while competitiveness decreases by 20%.) The UK does continue to produce some electric vehicles, importing the batteries for them, but given our significantly higher underlying costs our overall market share substantially shrinks down to lines where those costs can be absorbed.

For each scenario, we modelled the likely future evolution of UK global market share for:

- Traditional internal combustion engines vehicles and low carbon vehicles

- For sale in the UK, EU and Rest of the World

A full methodology and more details on our methodology are given in Appendix B.

Given the scale of the disruption facing the industry in the next decade - much of it with relatively little precedent - perfectly forecasting the future of the industry is difficult, if not impossible. However, we believe that these scenarios capture plausible future scenarios for the industry’s level of production and economic contribution, and roughly cover the same territory as other independent forecasts that have been produced.

In our central scenario, after recovering from the Covid-19 shock, total UK vehicle production continues to grow steadily in line with rising world demand - albeit never fully reaching earlier peaks. In the optimistic scenario, increased competitiveness allows UK production to grow substantially more than this with a growing world market share. However, the risks are asymmetric: in the pessimistic scenario, vehicle production continues a long term decline, while the stranded scenario sees overall production more than half from its level in 2016.

Vehicle Production (Public First forecast)

The prospects for economic activity are, if anything, more dramatic than this. In line with recent trends, we assume that average value per vehicle continues to grow across all scenarios as they become increasingly sophisticated with new technology and wider growing consumer wealth. This, alongside the rebound from 2020’s artificially suppressed number from Covid-19, ensures that total economic value (GVA) grows strongly in the Central scenario. It is only in the Pessimistic and Stranded scenario that GVA largely stagnates at the current level, which in itself is currently artificially low from Covid-19.

Automotive Manufacturing GVA (Public First forecast)

The impact on jobs, again, is likely to be significantly more dramatic. Continued automation and wider industry improvements will see average labour productivity continue to increase, and while there is considerable uncertainty, it is likely that electrification will lead to fewer workers needed per vehicle. As a result of this, even relatively static GVA could see falling jobs. Under the Stranded scenario, we estimate that over 90,000 jobs could potentially be lost, with a significant spillover effect on regional inequality. Assuming the current regional pattern of industry employment remains the same, over 35,000 of these jobs would be lost in the West Midlands compared to just 2,000 in London.

Automotive Manufacturing Jobs (Public First forecast)

Roadmap

How can the UK take advantage of the new potential from wider changes in the industry, while avoiding the risks of getting left behind?

Given that the full transition to decarbonised vehicles is not expected to take place into the late 2030s, it is easy to assume that we still have some time to put in place the right policies and infrastructure. In reality however, both consumer and industry decisions have long lead times.

While costs have been falling, change is not happening quickly enough for the industry on its own to organically hit the 2030 and 2035 targets. If we want to be in a position to meet the 2030 target and maintain the current economic value created by the automotive industry, we need to start putting in place the preconditions for success now: increasing affordability and UK competitiveness for international investors, expanding infrastructure and production facilities, and training up the workforce.

In this section, we set out some of the policy changes that will be needed - and as crucially when they are likely to have come on line. In order to ensure that we stay on track, we suggest the Government produces its own roadmap, showing how it plans to implement is Plan for Growth and Ten Point Plan for a Green Industrial Revolution , with reviewing it every two years.

Technology & Innovation

The coming transition to electric and smarter vehicles will require new types of skills, supply chains and production facilities to support companies from across the sector. The industry and Government should work together to build and create assets that can hold the industry, from guaranteeing sufficient battery capacity to developing new digital standards for Connected and Automated Vehicles.

Roadmap for Technology & Innovation

| 2021-2022 | 2023-24 | 2025-2030 |

| Government set UK target for battery production Expedite delivery of Automotive Transformation Fund Streamline processes for obtaining the necessary permits and licences for new production facilities Regulatory reform to enable commercial deployment of conditionally automated passenger cars by early 2022 Government & Industry develop long term skills and retraining strategy Pilot greater Apprenticeship Levy flexibility in the automotive sector | Battery and fuel cell gigafactories construction starts Strategically invest in R&D on step-change battery and fuel cell technologies UK builds domestic capacity for power electronics, motors and drive support Regulatory reform to enable highly automated cars, passenger shuttles and delivery vehicles no later than 2025 Pilot retraining schemes | EV production scales up, and ICE production ramps down Reach 60 GWh of battery production and 2 GW of fuel cell production Battery recycling and repurposing facilities commissioned Increasing share of miles driven is fully automated Retrain existing workforce |

Set an explicit target for the provision of 60 GWh of battery production within the UK by 2030. This would ensure that the UK has the capacity to produce up to one million electric vehicles domestically, and make it easier for UK produced vehicles to meet local content requirements, avoiding export controls. Without this level of infrastructure, the UK is unlikely to be a major manufacturing of ULEV vehicles in future, and the transition away from ICE vehicles will inevitably see the sector shrink. In order to secure this level of investment and continue substantial production in the UK, companies will need to invest in new facilities for power electronics, motors, powertrains and fuel cells - but they will not do this unless the UK is internationally competitive. The Government should ensure that UK tax incentives and other policies remain competitive with other potential European destinations for investment.

Support the development of a fuel cell gigafactory with a 2 GW capacity that is capable of supplying the production of 17,000 cars, trucks, buses and rail units by 2030. While battery electric vehicles may make up the majority of the consumer market, hydrogen and other technologies are likely to be particularly important for heavy vehicles. Having domestic supply of fuel cells can help maintain the current breadth of the UK supply chain.

The UK should seek to be the best place in the world to develop, test, trial and deploy Connected and Autonomous Vehicle (CAV) technology. The UK's combination of leading expertise in engineering and digital technology, combined with our tradition of innovation friendly regulation, puts us in a strong position to take a lead here, just as we have in fintech and health tech. As the Government’s recent Taskforce on Innovation, Growth and Regulatory Reform recommended, regulatory sandboxes can play a powerful role in building the evidence base on safety and new innovations.15 The Government should ensure that the Centre for Connected and Autonomous Vehicles (CAV) is resourced fully to address the many issues surrounding CAV development, including data, cyber security, connectivity, regulation and consumer understanding.

Develop a comprehensive and long-term skills and retraining strategy that supports needs across the sector. The industry is likely to require new skills in industrial chemistry, electrical engineering, virtual modelling, software design, cyber security and digital science, engineering and architecture. Given the automotive industry’s historically low rate of turnover, many of these skills will likely be delivered by retraining rather than new entrants. The Government should work with the industry to develop retraining bootcamps, and ensure that key skills requirements are included within local skills plans, taught in the Institutes of Technology and are on the shortage occupation list for skilled worker visas.

Pilot greater Apprenticeship Levy flexibility in the automotive sector to allow it to better support workforce retraining. Many large manufacturers, in particular, are currently unable to effectively spend their Levy contributions, and a more flexible system would allow them to better support the workforce's needs. The requirement for a minimum one-year apprenticeship should be eased, making it easier for the industry to retrain current workers.

Manufacturing Competitiveness

While domestic gigafactories are important, they are unlikely to be sufficient on their own to guarantee substantial foreign investment. In order to continue substantial production in the UK, companies will need to invest in new facilities for power electronics, motors, powertrains and fuel cells - but they will not do this unless the UK is internationally competitive. In the wake of Covid-19, many governments have pledged substantial public investment to help their economies build back better, and the UK should consider doing the same.

Roadmap for Manufacturing Competitiveness

| 2021-2022 | 2023-24 | 2025-2030 |

| Create new Build Back Better Fund Extend Coronavirus Job Retention Scheme through 2021, and provide additional business rate relief Expand access to EII schemes for auto sector and review free allocations for trade intensive sectors in UK Emissions Trading Scheme Fund trial demonstration projects for hydrogen in manufacturing processes Reform business rates and increase international competitiveness of R&D Tax Credits | BBB Fund starts making grants Reduce business energy costs to below the EU average to improve UK competitiveness Extend Climate Change Agreements and make EV batteries eligible Anticipatory investments in the most constrained electricity networks 1GW of hydrogen production capacity | Scale up use of hydrogen during production Ensure renewables deliver nearly 100% of electricity generation (2030) |

Create a new Build Back Better Fund to support good manufacturing jobs for the future. In the automotive industry, this fund could help support automotive production line transformation, skills retraining, and business rates and energy costs relief. If this fund was of a similar order of magnitude to the funds recently proposed by the US and US, it would be over £10 billion in size. While the fund should not act as a general subsidy, it should help support any industry with significant transformation costs from Net Zero, and provide match funding for private sector investments with significant positive externalities. Having a more flexible support regime could ensure that the UK remains competitive with other advanced economies as a location for investment, and help secure domestic production for industries from chemicals to semi-conductors.

Build Back Better investments by other countries

In the United States, President Biden has proposed a new infrastructure bill totalling over $2.2 trillion of spending with just under $200 billion going towards green automotive infrastructure. It includes an $100 billion subsidy for consumers buying electric vehicles, a mass expansion of the country’s charging station network, an increase in the country's domestic semiconductor production and electrifying the entire federal fleet over the next ten years.

The European Union has also announced its own 800 billion euro Recovery and Resilience Facility. At least 25% of which (and the greater EU budget) will support European Green initiatives and digitalisation. To guarantee that the funding is not misused the European Commission must sign off each individual country’s applications. Applications to the fund have already been made to support Renault in France, Fiat Chrysler in Italy and Volkswagen in Slovakia. Additionally, these and other EU countries have announced expanded subsidies for EVs, scrappage schemes for petrol cars and much more. At the recent G7 meeting in Cornwall, the G7 leaders agreed a new Build Back Better World scheme to help support infrastructure investment in low and middle-income countries, with a focus on climate, health and health security, digital technology, and gender equity and equality.

The Net zero critical industires, such as the manufacturers of low carbon and hydrogen vehicles and batteries, should be allowed to access the same benefits and compensation schemes as Energy Intensive Industries.This should apply both to vehicle manufacturers and their wider supply chain.This would allow the companies to receive up to 85% of their Contract for Differences (CfD), Renewables Obligation (RO) and Feed-in Tariff (FiT) costs, and ensure that the legacy costs of past renewables subsidies does not perversely hold back other elements of the wider transition to net zero. At the same time, more needs to be done to reduce carbon leakage, and the UK’s ETS free allowance schemes should take into account the high trade intensity of sectors like automotive. Climate Change Agreements should be extended and EV battery manufacturers made eligible.

Ensure the UK tax system creates a globally attractive destination for foreign investment. In order to encourage greater investment, the Government should consider removing plant and machinery from the business rates valuation, extending more generous capital allowances, and increasing R&D tax credits to a more internationally competitive level. As important as headline rates, is reducing business uncertainty or abrupt changes to policy or taxation rates - both of which reduce business confidence to invest.

Continue to support the industry through the aftermath of Covid-19 and wider spillover effects, such as the global semi-conductor shortage. The Coronavirus Job Retention Scheme should be extended through the rest of 2021, and additional business rate relief provided.

Fund trial and demonstration projects to explore the use of hydrogen during manufacturing. At present, there are few financial incentives for individual manufacturers to deploy hydrogen, and help establish best practice for future wider deployment. The Government should ensure its upcoming National Hydrogen Strategy is adequately funded, and includes resources to support initial demonstration projects.

Consumer, Market & Trade

While the cost of zero carbon vehicles is falling, by itself this trend is not likely to operate fast enough to meet the Government's 2030 target. Just as public support was needed to catalyse and accelerate the shift to renewable electricity, we will need additional Government help to ensure the wide availability of affordable vehicles and charging points by the end of the decade.

Roadmap for Consumer, Market & Trade

| 2021-2022 | 2023-24 | 2025-2030 |

| Announce further short-term incentives for EV consumer and fleets Commission independent review into fuel, vehicle & road taxation Better scope charging network need and publish EV Infrastructure Plan with firm commitments for expansion Introduce regulation on consumer experience of charging ----- Conclude renegotiations of continuity deals with major trading partners Support sector’s adjustment to new customs requirements in trade with the EU Develop trade strategy for major export markets |

Government responds to taxation review Expansion of charging infrastructure networks to ensure adequacy of provision and social equity ----- Sign trade deals with major markets (US, CPTPP etc) Review impact of end of phase-1 of TCA transitional rules on electrified vehicles, batteries in 2023 Support delivery of 2025 border strategy |

Reach 2.3 milllion public chargers by 2030 Long term taxation changes phased in Consumer education campaign on coming phase-out ----- Expand UK’s global market share Review impact of end of phase-2 of TCA transitional rules in 2026 Support delivery of 2025 border strategy |

Develop a infrastructure strategy to ensure that at least 2.3 million public charging points are in place by 2030. Current levels of private and public funding is unlikely to be enough to deliver this on its own. Public support is likely to be particularly important to deliver additional on-street chargepoints, and to ensure that less prosperous areas of the country do not get left behind.

Commission an independent review to holistically consider the long term future of fuel and vehicle excise duty in a decarbonised sector. The current Vehicle Excise Duty review has a relatively narrow mandate, but much more significant changes will be needed to create a sustainable tax base. Together, fuel duty and vehicle excise duty currently contribute around £38 billion in tax revenue a year, with the majority of this coming from fuel duty. In the long run, as the sector moves away from fuel, the government will need to change to a different system of taxation if they wish to replace this revenue. If we want individuals and families to invest in electric vehicles, they need longer term certainty on motoring taxes as we need to ensure that they have confidence about the running costs that they are likely to face - and that they will not be surprised by new taxes down the line.

Ultra Low Emission Vehicles should be exempt from tax for the next five years. This should include exemptions from VAT, Vehicle Excise Duty and Company Car Tax. At present, UK consumer incentives are significantly less generous than in other countries (see Appendix A).The current Plug-in Grant scheme should also be extended, and together these measure would help bridge the gap until ULEV vehicles can reach cost parity on their own, and give manufacturers increased confidence to invest in ULEV production earlier.

Work with the industry to develop an ambitious, forward looking trade strategy, which targets automotive’s most important markets, including the EU. The UK should use its new trade freedoms to expand market access for the sector, with particular opportunities for high end vehicles that sell globally and a supporting regulatory framework that ensures continued market access for existing and next generation vehicles.